Mortgage Broker Glendale CA: Secure the most effective Rates and Funding Options

Mortgage Broker Glendale CA: Secure the most effective Rates and Funding Options

Blog Article

The Comprehensive Function of a Home Mortgage Broker in Protecting the very best Lending Choices and Prices for Your Home Purchase

A home loan broker acts as an essential intermediary in the home buying process, attaching buyers with a series of lenders to secure optimum finance options and rates. By examining private economic situations and leveraging market understandings, brokers are well-positioned to discuss beneficial terms and enhance the usually complex lending application procedure. This competence not only conserves time yet likewise enhances the possibility of acquiring useful funding. Recognizing the full degree of a mortgage broker's abilities can substantially impact your home-buying experience. When picking the appropriate broker for your demands?, what variables should you think about.

Recognizing the Mortgage Broker's Duty

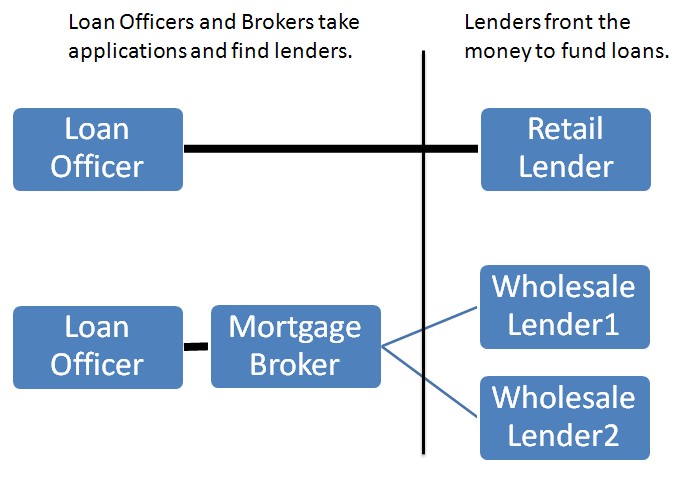

Mortgage brokers frequently function as intermediaries in between lenders and borrowers, promoting the finance purchase process. Their key duty is to analyze the monetary demands of customers and match them with ideal home mortgage items from a range of loan provider. Mortgage Broker Glendale CA. This needs an extensive understanding of the home mortgage landscape, consisting of different funding kinds, rate of interest prices, and lender needs

Brokers begin by collecting crucial financial information from customers, such as income, credit report, and existing financial debts. This data is crucial for establishing the most ideal funding options readily available. As soon as the needed information is gathered, brokers carry out thorough market research to identify lending institutions that straighten with the consumer's needs, commonly leveraging well-known partnerships with numerous banks to secure competitive terms.

Furthermore, home mortgage brokers give advice throughout the whole lending application procedure. They aid customers in finishing documents, making certain compliance with lender requirements, and offering advice on enhancing creditworthiness if required. By acting as a bridge between lending institutions and debtors, mortgage brokers improve the often-complex procedure of protecting a home loan, inevitably conserving customers effort and time while enhancing the likelihood of safeguarding desirable funding terms.

Benefits of Using a Home Loan Broker

Additionally, mortgage brokers have access to a broad variety of loan provider, which enables them to present customers with a variety of choices that they may not discover separately. This access can result in a lot more affordable prices and terms, inevitably saving borrowers cash over the life of the financing.

An additional benefit is the time-saving facet of collaborating with a broker. They handle the complicated paperwork and settlements, improving the application process and minimizing the worry on debtors. In addition, brokers can provide tailored support and suggestions throughout the financing journey, cultivating a sense of self-confidence and clarity.

How Home Mortgage Brokers Contrast Lenders

Brokers play an essential role in contrasting lending institutions to identify one of the most appropriate choices for their clients. They possess comprehensive expertise of the home loan market, consisting of various lenders' products, prices, and terms - Mortgage Broker Glendale CA. This know-how allows them to perform comprehensive assessments of the readily available lending alternatives based upon the one-of-a-kind monetary conditions and preferences of their clients

Home mortgage brokers use specialized devices and databases to gather current information on multiple find more info lending institutions successfully. They assess crucial factors such as interest rates, car loan charges, payment terms, and qualification needs. By comparing these components, brokers can highlight the benefits and drawbacks of each alternative, ensuring their clients make educated decisions.

Additionally, brokers maintain partnerships with a varied range of lenders, consisting of standard financial institutions, credit rating unions, and alternative funding sources. This network permits them access to unique bargains and possibly far better terms that may not be readily available straight to consumers.

Inevitably, a home loan broker's capacity to contrast lending institutions empowers customers to secure competitive prices and beneficial finance problems, enhancing the procedure of locating the best home mortgage service customized to their private demands.

The Car Loan Application Refine

Browsing the loan application procedure is a critical action for clients seeking to secure financing for their homes. This procedure normally begins with the collection of required documents, consisting of income verification, credit score reports, and asset declarations. A home mortgage broker plays a crucial role here, guiding clients with the paperwork and guaranteeing all information is accurate and full.

As soon as the paperwork is collected, the broker sends the finance application to multiple lenders, assisting in an affordable environment that can bring about far better terms and prices. They likewise aid customers recognize various car loan choices, such as fixed-rate, adjustable-rate, or government-backed finances, making sure the chosen item lines up with their economic circumstance.

Throughout the underwriting procedure, which includes loan providers examining the debtor's creditworthiness and the property's value, the broker works as an intermediary. They communicate updates and attend to any added requests from the lender, streamlining the process for clients. This assistance is crucial in reducing tension and confusion, eventually accelerating the approval timeline. By leveraging their know-how and market relationships, home loan brokers boost the chance of a successful finance application, allowing clients to relocate more detailed to homeownership with self-confidence.

Tips for Selecting the Right Broker

Choosing the right mortgage broker can substantially impact the general lending experience and result for clients. To guarantee a successful collaboration, take into consideration the following click to read ideas when picking a broker.

First, assess their experience and online reputation within the sector. Search for brokers with a proven record in securing positive financing terms for clients with varying economic profiles. Mortgage Broker Glendale CA. Reading evaluations and looking for recommendations from trusted resources can provide valuable insights

2nd, analyze their variety of lending institution links. A broker with accessibility to multiple lending institutions will certainly be better positioned to offer varied car loan choices and affordable rates, ensuring you discover the best fit for your needs.

Third, ask about their communication design and accessibility. A receptive broker who prioritizes client communication can assist reduce tension throughout the home lending procedure.

Finally, guarantee they are clear concerning their costs and compensation framework. A trustworthy broker will give a clear failure of costs upfront, aiding you stay clear of unforeseen expenditures later.

Final Thought

In recap, the thorough role of a home mortgage broker is vital in navigating the complexities of home financing. By leveraging market understanding and bargaining desirable terms, brokers improve the possibility of securing ideal financing options and rates. Their experience in comparing lenders and simplifying the finance application procedure significantly profits buyers. Selecting the appropriate mortgage broker can result in a much more efficient and effective home purchasing experience, inevitably adding to informed financial decision-making.

A home mortgage broker offers as an essential intermediary in the home acquiring procedure, connecting purchasers with a variety of loan providers to secure ideal lending alternatives and prices.Mortgage brokers often act as middlemans in between lending institutions and consumers, helping with the car loan acquisition procedure.Additionally, home loan brokers supply support throughout the whole funding application process. By offering as a bridge between lenders and borrowers, home loan brokers improve the often-complex procedure of protecting a mortgage, eventually saving customers time and initiative while boosting the possibility of safeguarding favorable lending terms.

By leveraging their competence and sector relationships, home loan brokers improve the possibility of an effective finance application, enabling customers to relocate better to homeownership with self-confidence.

Report this page